Opinions expressed by Entrepreneur contributors are their own.

Key Takeaways

- Capital was extremely cheap in 2020-2021, but inflation forced the Fed to hike rates sharply in just over a year. VCs moved from “scale fast, fix later” to demanding clear paths to profitability and free cash flow.

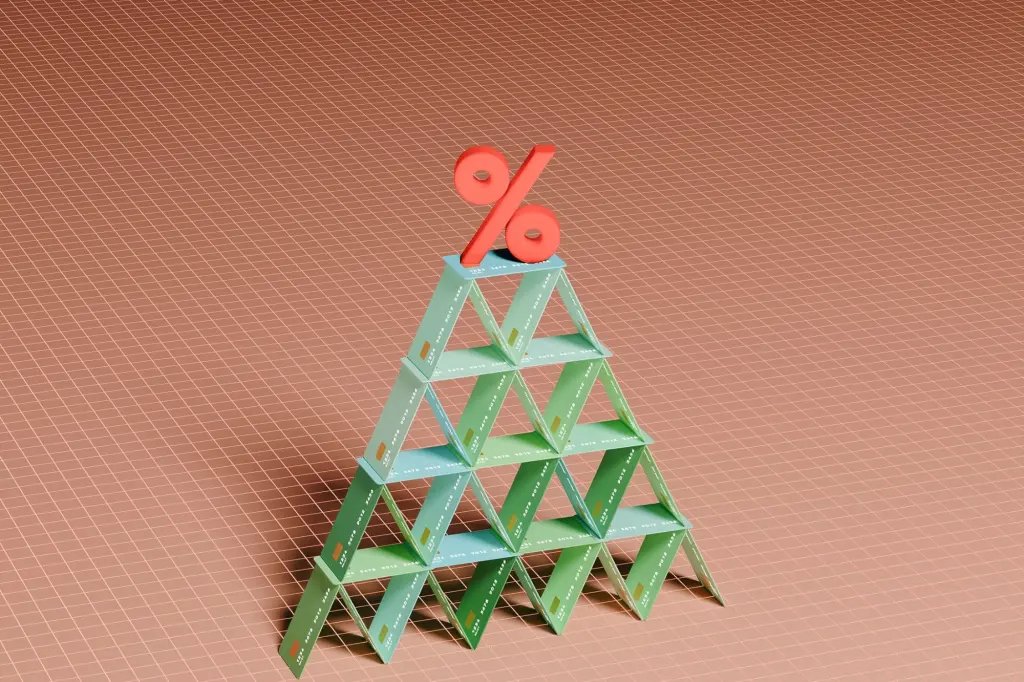

- Money moves in cycles, and founders who forget that risk building their business on shaky ground.

- Build in resilience, diversify funding sources, be transparent about how you’re adapting to interest rate realities and understand that time matters when it comes to investor sentiment.

Back in 2020 and 2021, capital was almost free. The Fed slashed rates to near zero to keep the economy afloat during the pandemic. Venture firms and banks were handing out money faster than founders could build pitch decks. If you had an idea and a half-convincing slide on TAM, you could get a meeting — sometimes even a check.

But inflation changed everything. By mid-2022, it hit 9.1% — the highest in four decades.

The Fed had to slam the brakes, raising rates from basically nothing to above 5% in just over a year. That whiplash left startups caught in the middle. A friend of mine had been planning to roll over a $2 million credit line at 3%. Overnight, the rate more than doubled. That “just in case” line suddenly turned into a cash-burning liability.

The lesson: Money is never permanently cheap. It moves in cycles — and founders who forget that risk building their business on shaky ground.

Is the Fed behind the curve?

People love to debate whether the Fed is “behind the curve.” In plain English, that means: Did they wait too long to act on inflation, and are they now making up for it by staying too tight for too long?

In 2021, the Fed kept calling inflation “transitory.” It wasn’t. By the time they admitted it, aggressive hikes were the only option. Fast-forward to today: Inflation has cooled to about 2.8%, but borrowing costs are still high. Some argue the Fed risks choking off growth. Others say they can’t afford to ease too quickly because another energy shock or supply chain crunch could send prices spiking again.

For founders, this isn’t just policy chatter. It shapes the cost of every loan, every investor decision and every valuation conversation.

The entrepreneurial lens

When I was raising funds for my first venture, I remember the impact of rates on investor psychology. In 2016, when money was relatively cheap, VCs were willing to overlook messy unit economics. “Scale fast, fix later” was common advice. But in 2023, when I was supporting a different project, the same pitch would have been dead on arrival. Suddenly, every investor wanted to know: How soon until profitability? What’s your path to free cash flow?

Interest rates influence the invisible backdrop against which these conversations happen. They determine whether risk capital flows freely or cautiously trickles. For entrepreneurs, understanding that backdrop is as important as perfecting your product roadmap.

The numbers tell the story:

-

Global venture capital funding dropped 17% from Q1 2025 to $109 billion in Q2 2025.

-

Surveys in 2025 still show that access to affordable financing is one of the top three headaches for U.S. startups.

Behind those stats are real people: the SaaS founder who paused expansion because capital got too pricey, the ecommerce startup forced to hit profitability two years ahead of plan, the hardware company that had to cut a creative revenue-sharing deal with suppliers instead of taking on debt.

The challenges right now

These challenges force founders to rethink their playbook:

-

Cost of capital: Loans, credit lines and even convertible notes are far more expensive.

-

Lower valuations: High rates mean investors discount future earnings harder, which drags valuations down.

-

New investor mindset: Growth for growth’s sake doesn’t sell anymore. Profitability does.

-

Longer fundraising cycles: Deals take longer, and closing cash takes patience.

Advice for entrepreneurs

So, how should founders navigate the current interest rate landscape?

-

Build in resilience: Don’t count on the Fed to rescue you with cheap money. Structure your financing assuming today’s rates will persist. If they drop, you gain upside.

-

Diversify funding sources: Explore revenue-based financing, customer prepayments or strategic partnerships. These alternatives can reduce dependence on costly debt or dilutive equity.

-

Communicate the macro context: Investors know the environment is tough. Be transparent about how you are adapting to interest rate realities. It signals awareness and strategic foresight.

-

Time matters: If you’re not in urgent need of capital, waiting a few quarters might shift the playing field. Rates may not plunge, but even small cuts can ease investor sentiment.

In short, founders need to be students of both microeconomics (their business model) and macroeconomics (the Fed’s decisions). Ignoring one side leaves you vulnerable.

The long game

Are we on the cusp of a new easing cycle, or will the Fed keep its foot on the brake longer? No one knows with certainty. But one truth endures: Cycles are inevitable. What matters is how well you position your business to survive the tough phases and thrive when conditions ease again.

I’ve lived through both ends of the spectrum — the exuberance of cheap capital and the sting of expensive debt. Each cycle reshaped how I think about building a company. If there’s one takeaway, it’s this: Interest rates aren’t just a backdrop to your business story. They are an active character, shaping the choices you make, the risks you take and the outcomes you achieve.

Entrepreneurs don’t get to set Fed policy. But they do get to decide how prepared they are for its consequences. And preparation, more than prediction, is what determines who makes it through to the next cycle.

Key Takeaways

- Capital was extremely cheap in 2020-2021, but inflation forced the Fed to hike rates sharply in just over a year. VCs moved from “scale fast, fix later” to demanding clear paths to profitability and free cash flow.

- Money moves in cycles, and founders who forget that risk building their business on shaky ground.

- Build in resilience, diversify funding sources, be transparent about how you’re adapting to interest rate realities and understand that time matters when it comes to investor sentiment.

Back in 2020 and 2021, capital was almost free. The Fed slashed rates to near zero to keep the economy afloat during the pandemic. Venture firms and banks were handing out money faster than founders could build pitch decks. If you had an idea and a half-convincing slide on TAM, you could get a meeting — sometimes even a check.

But inflation changed everything. By mid-2022, it hit 9.1% — the highest in four decades.