The US Supreme Court overturned president Donald Trump’s so-called Liberation Day tariffs on Friday, striking down the sweeping duties that had cost businesses billions in fees and opening the door to a flood of potential petitions for refunds on levies already paid.

In a decision that had been anxiously awaited for months, the court ruled six to three that Trump did not have authority to levy tariffs using the International Emergency Economic Powers Act — a 1977 statute meant for emergencies, not routine trade policy. While lower courts had found that Trump exceeded his authority in his use of the act, his tariffs had been allowed to remain in force as legal proceedings carried on. (The ruling does not affect tariffs levied under other legal bases, such as the Section 232 tariffs Trump has put on products such as cars, semiconductors, steel and aluminum.)

In an opinion written by chief justice John Roberts, the court’s majority stated that Congress alone has the power to impose tariffs during peacetime, and referring to a previous Supreme Court ruling, noted “the president must ‘point to clear congressional authorization’ to justify his extraordinary assertion of the power to impose tariffs. He cannot.”

Trump called the decision a “disgrace” at a White House meeting with US governors, according to The New York Times.

Fashion stocks rose modestly after the ruling, with companies ranging from Vans owner VF Corp. to Abercrombie & Fitch seeing gains of up to 4 percent. Many investors had been anticipating the Supreme Court would rule against the tariffs after several conservative justices expressed scepticism of the Trump administration’s argument in a November hearing.

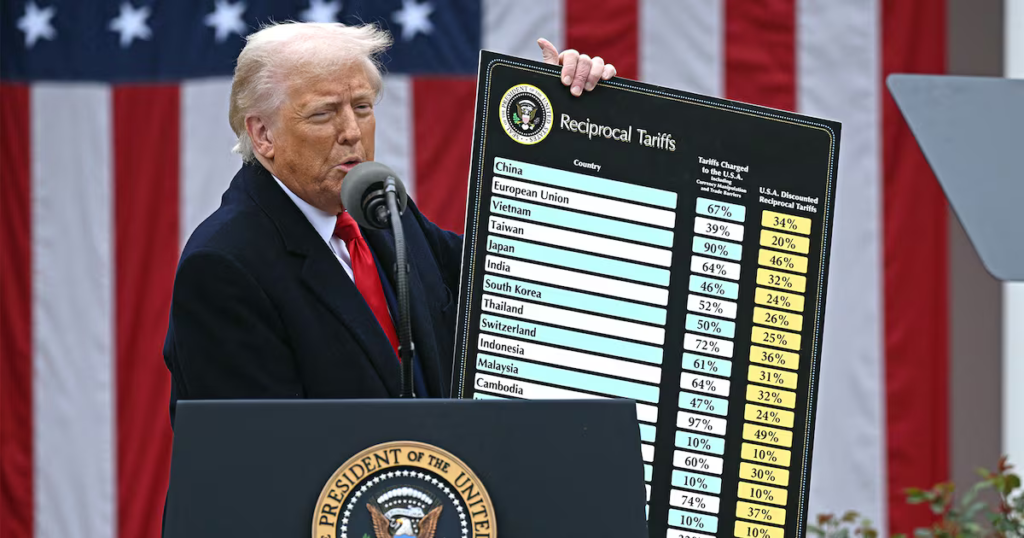

Trump’s April 2 tariff announcement sent a shockwave through the fashion industry, which imports billions of dollars worth of goods into the US and saw some of the largest manufacturing hubs, such as China and Vietnam, hit with the steepest levies. Those tariffs were later reduced as the US struck trade deals, but additional duties have remained in place on apparel and footwear sourcing countries. As of November 2025, the weighted average of tariffs on apparel and footwear imports to the US was 36 percent, up from 13 percent prior to the April announcement, according to the BoF-McKinsey State of Fashion 2026.

In a note to clients following the ruling, Needham analyst Tom Nikic called it “extremely important” for apparel and footwear brands, given that the IEEPA tariffs accounted for the bulk of tariffs dropped on the sector last year. “While the administration may seek out other avenues to levy tariffs on imports, at the very least this is a near-term positive for the group,” he wrote.

The tariff fight is expected to continue despite Friday’s Supreme Court announcement. The administration has said it will seek to reestablish tariffs under other trade laws, with US trade representative Jamieson Greer telling The New York Times in January that it would “start the next day” after an unfavourable ruling to reimpose duties.

In a January note to clients, TD Cowen said that the administration could use a combination of other legal measures to replace the IEEPA tariffs, such as sections of the Trade Act of 1974 and the Tariff Act of 1930. “These replacement authorities could be activated very quickly — potentially within 24 hours of the Court’s ruling,” Cowen analyst Tristan Margot wrote.

It’s uncertain whether these measures would be as extensive as the IEEPA tariffs and would extend to apparel and footwear.

What can companies do now?

While the fashion industry waits to see what other options Trump will turn to, many companies are determining whether they’re able to recoup the fees they paid under the now-invalidated emergency tariffs.

In a dissenting opinion, justice Brett Kavanaugh wrote that the court’s ruling “says nothing today about whether, and if so how, the Government should go about returning the billions of dollars that it has collected from importers.” But, he added, “that process is likely to be a ‘mess,’ as was acknowledged at oral argument.”

Any refund process is unlikely to be automatic, meaning importers may have to file protest claims with US Customs.

“There is a legal precedent to engaging with the government and filing protests, and then taking legal action if the outcome is not favourable,” said Matt Priest, president and chief executive of Footwear Distributors and Retailers of America, the largest footwear trade group in the US, in an interview last month.

In a statement Friday, Steve Lamar, president and CEO of The American Apparel & Footwear Association, also noted that Customs and Border Protection’s “recently modernized, fully electronic refund process should help to expedite this effort.”

Even before the court’s decision, more than 1,000 companies had already sued Trump in anticipation of a ruling against the tariffs. An analysis by Bloomberg found that apparel and textiles businesses led other industries in the number of suits filed.

The remedies that will be available to companies aren’t yet clear. If refunds do become available, businesses could need specialist trade counsel to navigate claims and compliance, with brands that proactively tracked tariffed entries better positioned for any recovery. Some companies have sold their rights to collect refunds to outside investors for pennies on the dollar.

Sexual wellness brand Dame told BoF last month that if it’s able to recoup some of the $100,000 it paid in extra import fees last spring, it would try to refund customers who paid an extra “Trump tariffs” $5 flat fee on orders purchased between April and May 2025. The brand collected about $7,000 from the surcharge, a fraction of its actual increased costs of production when tariffs on Chinese goods temporarily surged to 145 percent.

Returning the extra fee would be a gesture of goodwill to shoppers, said chief executive Alexandra Fine. “It feels like the right thing to do and customers will respond to it,” she said. “The ones that paid for it will remember they paid for it because a lot of customers didn’t check out when they saw the tariff fee.”

To prepare for a potential refund, Fine and her team are collecting all of their invoices from US Customs under the heightened tariffs. Last month, Dame also increased the prices of its products.

Easing pressure for fashion brands and retailers

Because any refunds would take months to materialise and Trump could institute new tariffs at any moment, brands must plan for continued cost volatility and other uncertainties in the near term. But businesses are hoping the cost pressures from Trump’s overturned emergency tariffs will at least ease.

The tariffs raised import prices for apparel and footwear, which brands have passed onto customers in the form of price hikes or absorbed at the expense of their margins. While consumers have for the most part continued shopping, if they were to pull back in the months ahead brands will have more flexibility to lower prices without eroding their margins, Priest said.

Importers may also reexamine their sourcing strategies in light of the court’s decision, though a complete reversal of changes already made in response to Trump’s April tariff announcement seems unlikely. Companies could find it expensive and impractical to shift course again, especially without any guarantees that conditions won’t suddenly change. Many have focused on diversifying their manufacturing away from China, and while Priest said China’s pricing has become very competitive again, brands may still be wary of relying too much on the country, which is a frequent target of Trump’s.

“It’s calm right now, but we’ve got three more years to go in this administration and it may not always be settled,” Priest said. “If there’s movement back to China, because China is still our number one supplier, I don’t think it’ll be this mass movement. The trend lines we’ve seen — and actually it started well before the president’s first term — I think those will still hold in place, and people will still want to make sure they have an eye on diversification, even if they’re moving some product lines back to China.”

Stay tuned to BoF for updates on this developing story.